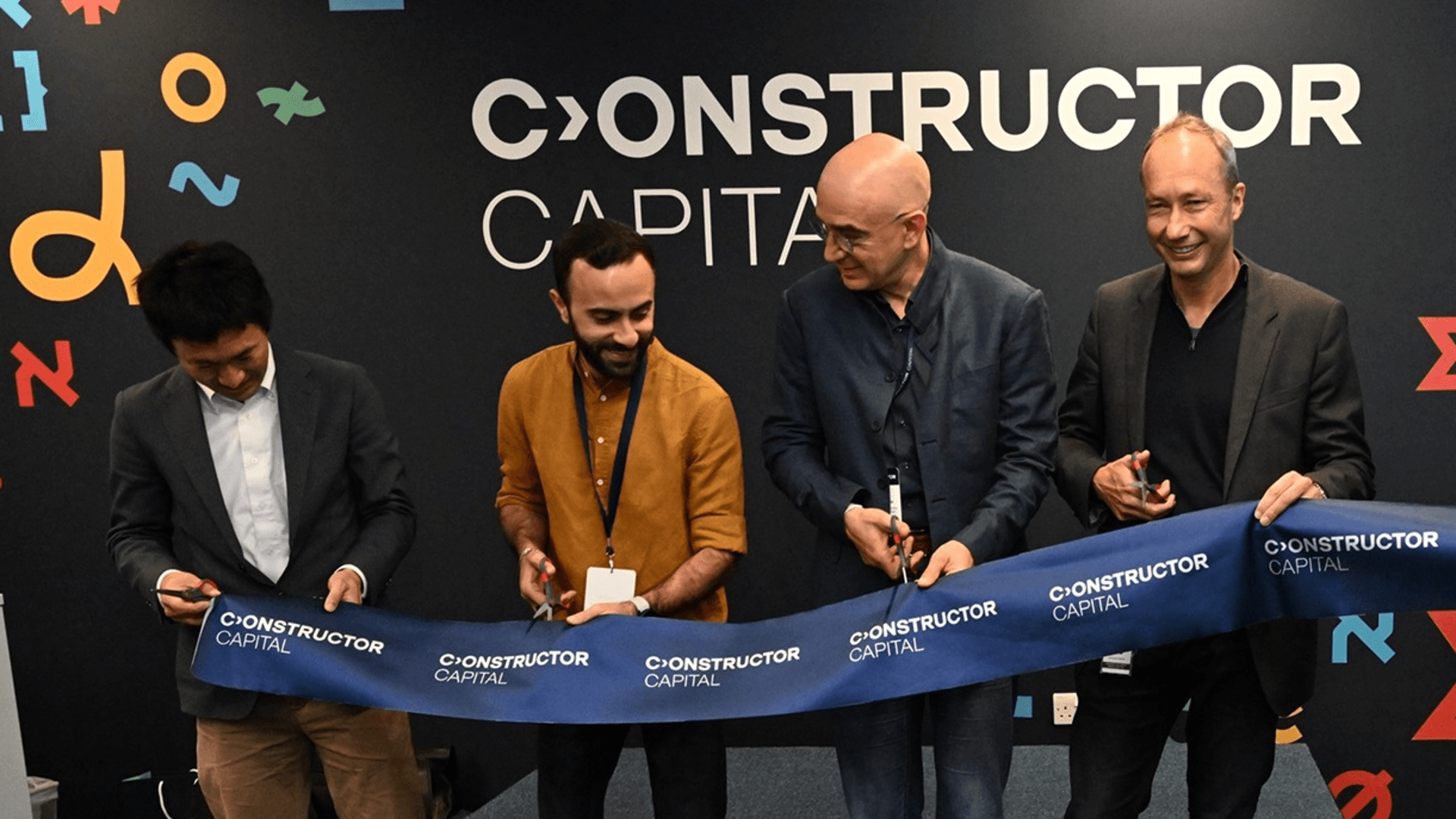

Constructor Capital, the Swiss venture arm of the Constructor Group, has announced the closing of its first fund with $110 million. The fund will focus on seed and Series A investments in startups active in the deeptech, software, and edtech sectors.

Science-focused Approach

Constructor Capital's approach is distinguished by a strong emphasis on science. The company leverages a network of over 50 universities and a broad base of academic researchers to assess the technical validity of startups and support them in the transition from laboratory to market. This model allows them to identify and support companies with advanced scientific foundations that may be underserved by traditional venture capital.

Constructor Group Ecosystem

Constructor Capital benefits from integration within the broader Constructor Group ecosystem, which includes Constructor University, research laboratories, an equity-free accelerator program, and platforms supporting research and applied innovation. This structure allows for the integration of scientific expertise into the investment process and supports portfolio companies as they transition to commercial markets.

Investments

The fund will invest globally, with a focus on Europe, the United States, the United Arab Emirates, and Singapore. Typical investments will range from $1 million to $10 million, with the possibility of up to $15 million for selected investments. The portfolio already includes companies such as QuEra Computing (quantum computers), Lumai (optical computing for AI), and GCore (AI infrastructure).

💬 Commenti (0)

🔒 Accedi o registrati per commentare gli articoli.

Nessun commento ancora. Sii il primo a commentare!